If you’re the owner of a privately-held company, eventually you’ll need to make a decision about the future of the company. All things come to an end after all – including your role in your business. But have you decided what you will do?

You’ve got three choices, says Rich Mander’s of Freescale Coaching, a long-time business colleague and friend as well as a successful serial entrepreneur in his own right. One, you can keep growing your business and learn what you need to learn in order to scale it successfully. Two, you can pass it on to the next generation – if in both of those cases you’ve done the work of securing a strong succession plan. Or three, you can “harvest” your business by selling it.

No matter what option you choose to pursue, however, to be sustainable, valuable and attractive to outside investors and funders, your business needs to SPARKLE!

That’s the simple acronym the Riverside Company, a private equity firm, used to evaluate companies that they’re considering for investment – and – the one that they used when acquiring one of Rich’s businesses, iAutomation, back in 2007. He’s used it ever since.

“I found that it’s a very helpful “checklist” that describes the things that you need to do to make your business stronger and better,” says Manders. “Even if you’re not planning on exiting. It’s just good business sense.”

At CEO Think Tank® we’ve used the model with our clients for several years since I first learned about it from Rich. Since then he did a presentation during the Strategies for Maximizing Your Exit at Harvard and it’s become a must-watch for our clients.

Schedule 45 minutes and check out the seven steps of his checklist below as you watch. Then ask yourself these three questions:

- How do they apply to your company?

- What should you be doing this year to strengthen your “achilles’ heel”?

- What do you need to put on your plan over the next two to three years to create a company that shines?

HINT: The less your business SPARKLEs, the better deal your buyer will get and the less that will end up in your wallet!

(Each SPARKLE section below has timecode relating to where Rich talks about them in the above video.)

Scrubbed and Cleaned (17:45)

Are you ready for outside parties to look through your business with a fine tooth comb? Would you be embarrassed if someone did?

Rich focuses heavily not just on the traditional financials that we typically think of when we talk about “the books” but also on the health and stability of your business’s agreements. Everything from ownership agreements down through supplier, employee, and customer agreements should be structured in such a way that it doesn’t give your buyers cause for concern. He echoes this sentiment in regards to the company’s financials and its operations as well.

Use an outsider’s perspective to look at your business, see where you’re most exposed, and “scrub”.

Powerful Management Team (30:12)

You grew your business successfully in part, because of an all-star roster of employees. The right people are in the right seats and driving the business’ growth. Additionally, there’s no “missing link” where an absence (including your own) would ruin the business. You have backups in place so your company can withstand any personnel shakeups that might occur.

Part of what buyers want is that amazing team to carry your past success into the future. How are you ensuring that the management team stays engaged and continues to support the growth of the business?

Attractive Facilities (32:55)

Being attractive doesn’t mean you have to spend an exorbitant amount of money to look like a Google campus, but your company’s appearance should instill confidence. If your company isn’t physically scrubbed clean, will someone bother to see if your books are?

Rising, Diversified Revenues and Margins (34:05)

Buyers want to see a history of ever-increasing sales, profits, and margins. Increased margins are a sign that you’re not just focused on the top-line but you’re also wringing operational efficiency out of your business.

Alternatively, if your sales are increasing but profits are stagnating leadership issues might be draining profits from your business. “That’s one of the biggest issues with the majority of businesses I look at,” says Rich, “They’re a leaky pipe. Dollars are coming in, and the profits are dripping out at the end and at all the cracks in between.”

(If you suspect that this is the case with your company, check out our upcoming Growth Strategies Breakfast with Howard Shore, author of ‘The Leaky Bucket’, on March 2nd.)

Klearly Articulated Value Proposition and Growth Plan (36:00)

How well defined is your strategy – now and in your business’s future? How well do you know your market and your customers, and is your plan to dominate your niche clearly laid out?

Just as important, what do your customers think about you? Do you know your Net Promoter Score? Are you succeeding with your current customers to the point that they’re promoting your business?

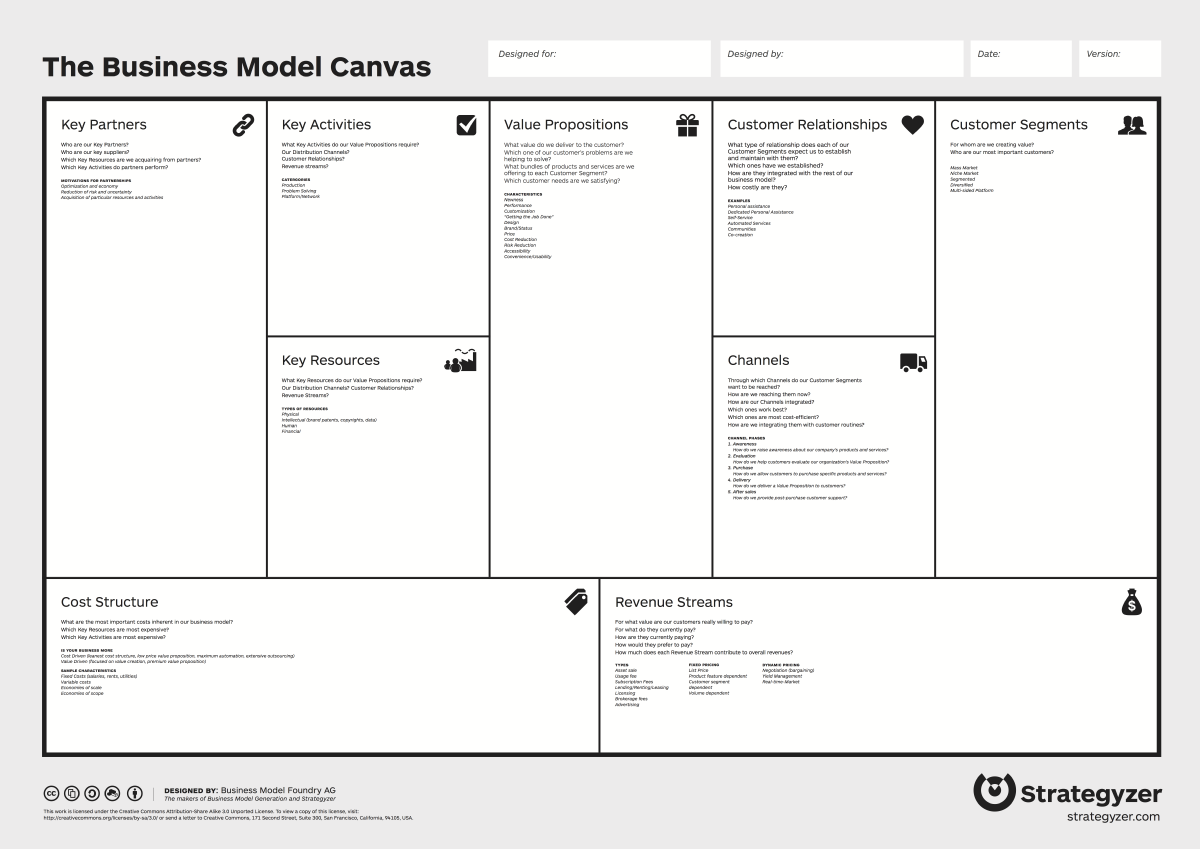

There’s a number of good resources and tools to help with the above. Reach out to us if you think that Strategy is your weak link. HINT: Rich also recommends using the Business Model Canvas as a way to quickly articulate the entirety of your business in a visual manner. Very appealing to prospective funders and investors!

Lots of Data (38:19)

“Most companies in the small and middle market have terrible data,” Rich shares.

What’s the one key data point in his talk? Profitability. How profitable is a customer? How profitable is a division? This employee? This geography? Rich’s company developed their own system to measure the return on their time spent. And they tracked it weekly and quarterly.

Think about how you track time spent on tasks. If you are tracking, what are you doing with the data? Are you analyzing it to make strategic decisions? It might reveal how some profits are leaking out of your business.

Excellent Preparation (40:09)

All of these items take time. You either have to refine it, shore it up or just plain fix it. “Don’t think in terms of months,” says Manders. “This stuff takes years.”

Even if you’re not sure what you’ll do with your company, following these guidelines as soon as you can means that you’ll be ready because –

! – Timing Matters

Sometimes life’s plan doesn’t coincide with our own and CEOs need to sell a business due to unforeseen circumstances. If you’re constantly grooming your business for sale, you’ll be ready to get the best value for the time and effort that you’ve put into it. Even if the timing isn’t on your terms, planning ahead will make a difference.

Tags: Business advice for the mid-market, Enlightened Executives, Executive Coaching, Executive Education for Small Business, Executive Roundtables, Leadership Development for Small Business, Leadership Development in New Jersey, Leadership Development in Philadelphia, Overcoming small business challenges, Small business advice, Strategic planning for small business